Screen shots - Paying IRD

Looking for the tutorial for payday filing? if you are looking for the payday filing tutorial, click here.

Looking for a tutorial about filing the New/Departing Employees information? if you need a tutorial about new/departing employees, click here.

This page demonstrates how to find the amount to pay IRD.

If you have not started payday filing yet, please read this section first:It really just involves clicking a few buttons - there is nothing complicated that you need to do.

Once you have done this once or twice it will become even easier.

Please have a look at this page at IRD: Payday filing - What is payday filing?

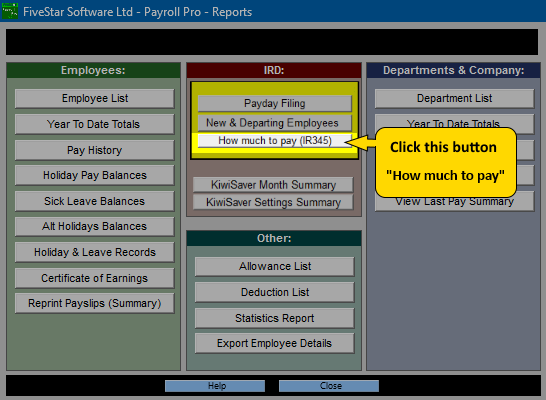

Step 1: Click "How much to pay".

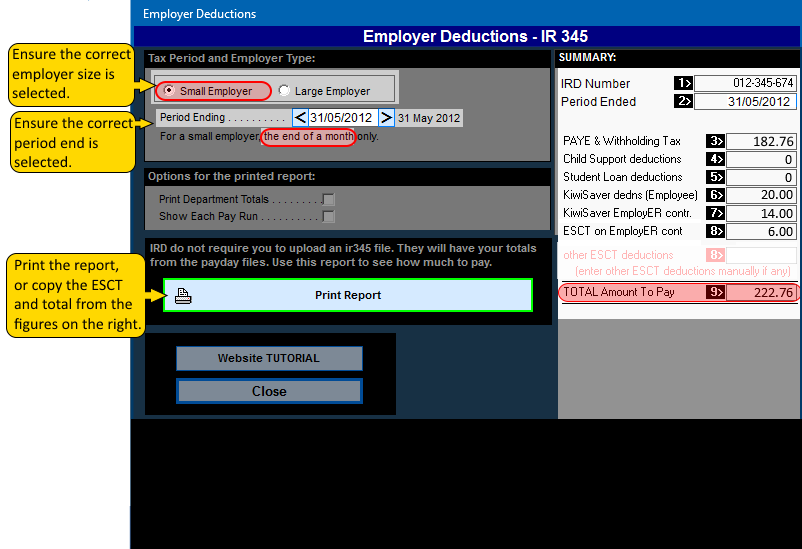

Step 2: Ensure the employer size is correct, and the period ending is correct.

Step 3: Print the report or note the "TOTAL Amount To Pay".

Step 4: Pay IRD.

You do not need to upload the IR345 anymore. The IRD's system will calculate the same figures. You can pay IRD as you always have, at the same time as previously.