Splitting an employee's pay between departments

You can split individual pays between two or more departments. To do this, you must have two or more departments set up (under Maintain Departments), and you need tell Payroll Pro you would like to split pays between departments under "Defaults & Setup".

Step 1

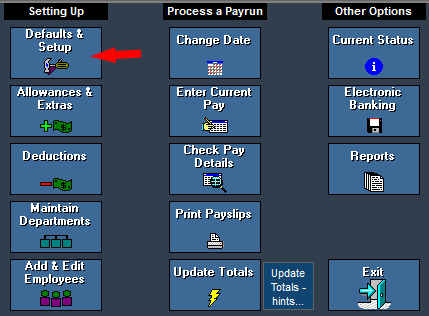

From the main menu, click Defaults & Setup.

Step 2

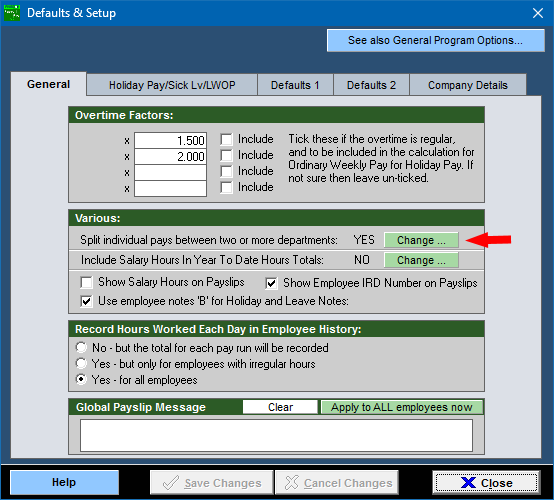

Check that the option "Split individual pays between two or more departments" is set to YES.

If not, click the "Change..." button.

Click "Save Changes" to return to the main menu.

Or, if the setting is already YES, just click "Close".

Step 3

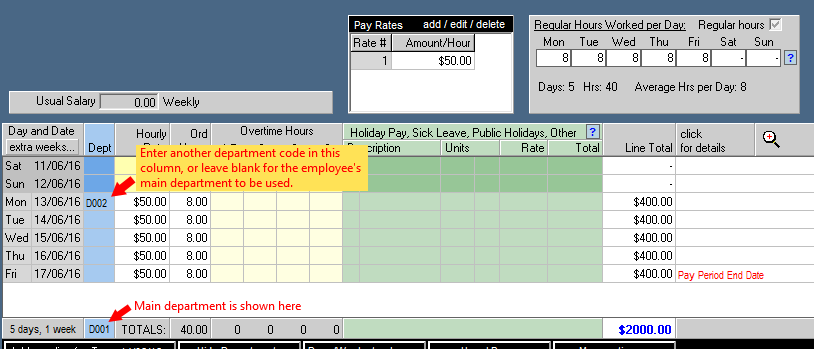

To enter a different department for part of the employees pay, select "Enter Current Pay", and go to the "Time Sheet".

You will now see the department column. Leave the department column blank to use the employee's main department, or enter a different department code into the column. In this example the employee's main department is D001, but on Monday 13/6/16 the employee is working in department D002.

The employee worked in their main department D001 on Tuesday to Friday, but in department D002 on Monday.

Note 1

For the next pay, the department column will be set back to blank (to be the employee's main department) so you don't have to remember to do this yourself..

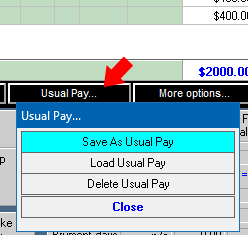

However if you would like the pay to remain the same for the next and subsequent pays (department splits and hours), you can save this pay as the "usual pay". To save as a usual pay:

Click "Usual Pay" then click "Save As Usual Pay".

Note 2

Splitting between departments assumes the departments are just departments within the same employer (so the departments are all under the same company IRD number). Separate payroll companies would be used if each department represented a different employer (ie different employer IRD numbers), and also an employee would be on a secondary tax code when paid under one of these other employers.

So, when a pay is split between departments, the hours and gross dollar amount are analysed out, and put into the separate department totals. This is fine since it is the gross and hours figures which are used for accounting analysis purposes.

However, the IRD deductions such as PAYE, Student Loan and Child Support are analysed to (put into) the employees main department. Due to the tax rules, there really is no one way to split PAYE etc up, so these are put into the employees main department to avoid confusion.

This will not have any affect on the totals which go to IRD on the monthly schedule, since the figures which go to the IRD on the IR348 and IR345 are the totals of all departments (= the company/employer total).

Note 3

The report created during the Update Totals keeps things simple by just showing each employee in own main department. Showing splits could lead to a very large report which would be difficult to read. But don't worry - the gross figures for accounting purposes can be found from both the year to date department report and for more detail, the department pay history report.