Salary Adjustments

On this page:

New Employee Salary for a few extra days or a few less days

To change the salary for just one pay

See also (not on this page):

Holiday Pay for Salaried Employees

To change the annual salary

This is changed in the TimeSheet window under "Enter Current Pay".

(Note that if you are only wanting to change the salary for this pay for a special reason and are not wanting to change the annual salary, you would not change the annual salary, but only "Salary This Pay". See the sections further below for this).

- From the main menu, select "Enter Current Pay"

- Select the required employee.

- Go to the TimeSheet by clicking on the "TimeSheet" tab.

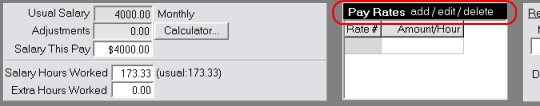

- At the top of this window you will see a black bar showing the words "Pay Rates add/edit/delete". Click this.

- The annual salary box will then appear - you can change this and click "Done".

- The usual salary per pay period to the top left will automatically recalculate.

New Employee Salary for a few extra days or a few less days

The salary for the current pay can be adjusted to include a few extra days if your employee started during a pay period and you do not want to pay them until a full pay period has finished. Alternatively if the employee started during the current pay period the salary for the current pay could be reduced accordingly.

Here is an example using an employee on an annual salary who is paid the salary weekly:

Weekly salary $500 (5 days per week so $100 per day)

The employee works Monday to Friday.

This Pay Period ends Friday 24 August, and the employee started work on the Thursday the week before.

Therefore employee is being

paid for 7 days for this pay (last Thursday and Friday, and Monday to Friday this week).

The usual salary per week will be $500, but for just this first pay can be overridden to $700.

Another example, paying the employee for the first part pay period:

Weekly salary $500 (5 days per week so $100 per day)

In this example the employee will usually work Monday to Friday, but starts employment on a Wednesday.

The employee is therefore only paid for 3 days for their first week: Wednesday to Friday.

The usual salary per week will be $500, but for just this first pay can be overridden to $300.

Of course you may as an employer be paying the employee a full weeks salary for the first week even though they only worked 3 days. If this is your agreement with your employee, then you would not need to override the salary.

To make the adjustment, please see the next section, in particular #2 below.

To change the salary for just one pay

There may be times when you want to adjust the salary for just the current pay for some reason. Two ways to do this are:

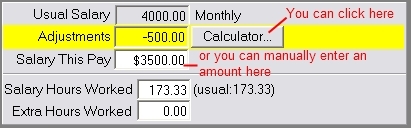

- You can use the calculator button which shows to the right of the "Adjustments" box. This helps if you need to make a calculation to reduce salary by the equivalent of a certain number of hours. After using this, the "Salary This Pay" will automatically recalculate for you. To clear the adjustment you can either click the calculator button again and enter 0 hours to reduce the salary, or you can type directly into the "Salary This Pay" box.

Note - this calculator cannot be used if the regular hours for the employee are not set, as Payroll Pro has no way of knowing how many hours equate to a day or a dollar amount. In this case a manual adjustment would need to be made, or you will need to enter some regular hours for Payroll Pro to use for calculations. Regular hours are entered in the box to the top right beside the pay rates box. If you don't know what to enter, we suggest entering the hours per day you would use for a day of leave.

- You can manually calculate the salary for this pay run and enter it into the Salary This Pay box. If you do this, then the "Adjustment" amount will automatically recalculate for you.

In either case you can manually change the "Salary Hours Worked" if you use this information, or if you don't need to record the salary hours you can ignore the salary hours boxes. The "Salary This Pay" will automatically revert to the "Usual Salary" for the next pay.