Screen shots - IRD Filing (IR348 and IR345)

Step 4: For Small Employers (once per month filing):

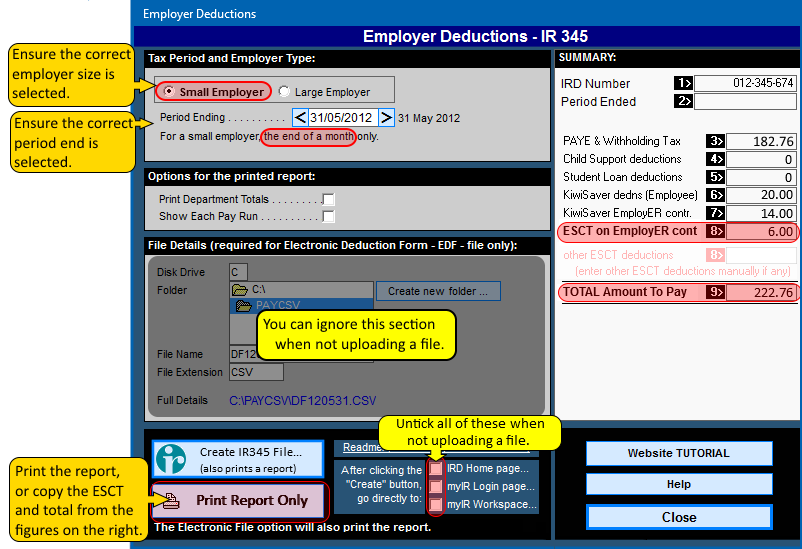

The IR345 (Employer Deduction Totals)

The IR345 contains the ESCT totals which are not available from the IR348. This will not be relevant if you do not have any employees in KiwiSaver - but if you do have any employees in KiwiSaver you will need the ESCT totals.

> Select "Small Employer".

If you are on this page you are probably a small employer, so ensure small employer is selected. (A small employer files the IR345 once per month, but a large employer files the IR345 twice per month).

> Ensure the Period End Date is correct.

For a small employer, this is the end of a month only.

> Ignore the file details.

If you are on this page, you are probably a small employer and not wanting to create an uploaded IR345 file. So you can ignore the file details.

> Untick all "go directly to IRD" boxes.

If you are on this page, you are probably a small employer and not wanting to create an uploaded IR345 file, so you do not want to be sent to the IRD page at this stage.

> Print the report (best option), or at least note the ESCT and TOTAL Amount To Pay

Make sure you print the report, or at least make a note of the ESCT and TOTAL Amount To Pay. The report contains the information contained in the file including ESCT, and the location of the file.

You can click anywhere on the image below to see the next step. The image below is from Payroll Pro Version 2.48. If you have not already updated, or if you are using Payroll Pro version 1, this will look a little different, but the general idea is the same.

Step-1 Step-2 Step-3 Step-4 Step-5 Step-6 Step-7 Step-8 Step-9 Step-10 Step-11 Step-12 Step-13